E. Wright

Repair timelines have gone up by roughly 20% post pandemic. Heres a few reasons why.

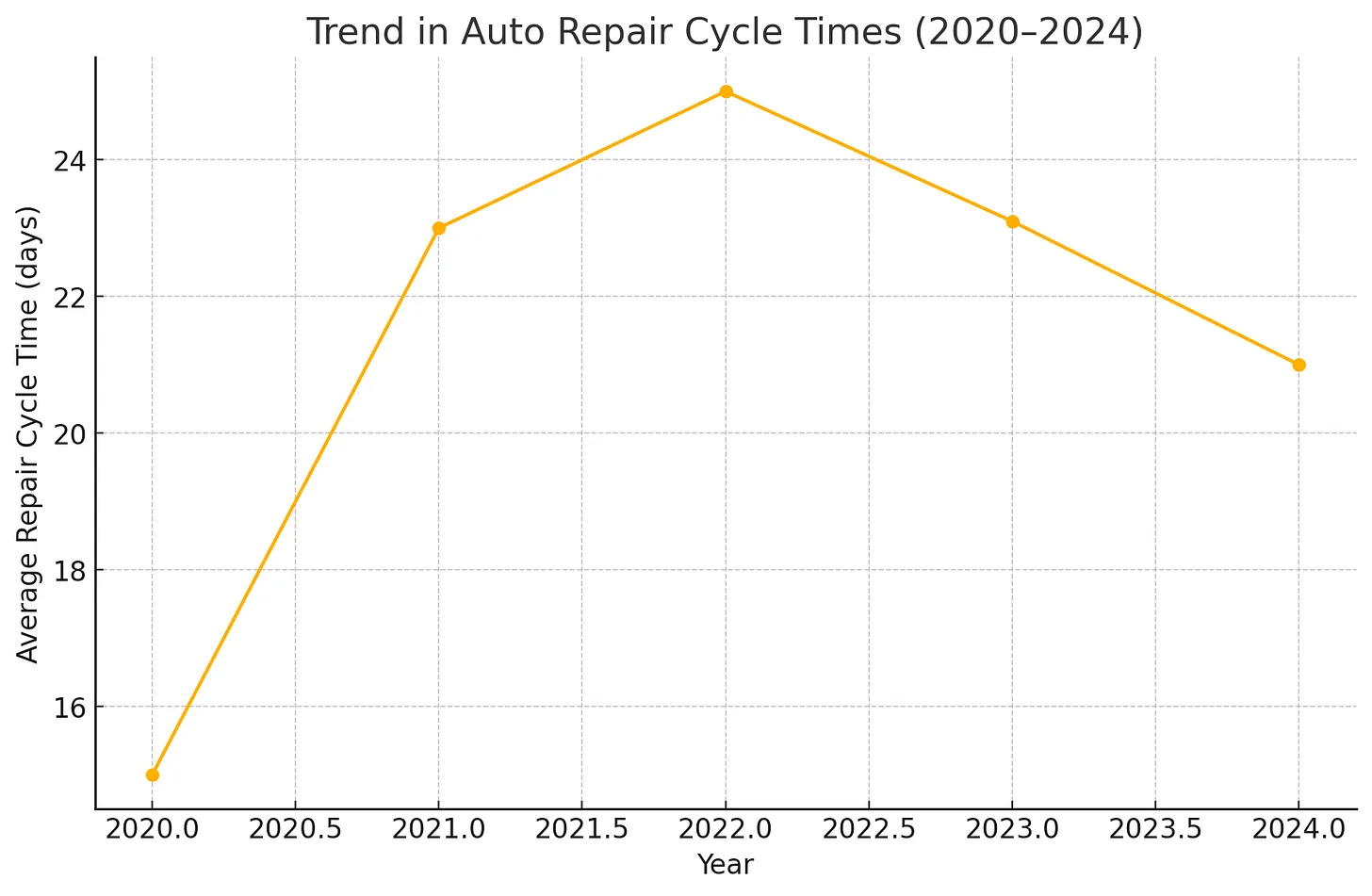

If you’ve been in a fender-bender recently, you might be surprised by how long it takes to get your car back from the shop. Ongoing supply chain issues and parts shortages continue to plague auto repairs in 2025. The average insurance repair “cycle time” – the time from filing a claim to getting your repaired car returned – reached about 23 days in recent years, up dramatically from roughly 12 days before the pandemic. Some repair shop owners report that fixes which once took only three weeks can now stretch to two or three months, and rare cases even longer (one driver waited eight months for a back-ordered door). The situation has improved slightly since the peak of the shortages, but repair times are still longer than normal as we enter 2025.

Longer Cycle Times Impact the Claims Process

These parts delays directly affect the auto damage claims process. When you file a claim, be prepared for a longer overall timeline for repairs. Insurers and repair shops alike are coping with lingering backlogs and delayed parts delivery. In fact, by 2023 the average repair cycle time hit a record high of 23.1 days (more than double the 2021 average). This means you could be waiting weeks for your car’s parts to arrive and repairs to be completed. One consequence is longer rental car usage: many drivers exhaust their insurance-covered rental period and end up paying out-of-pocket to keep a rental while their vehicle sits in the shop. Customer satisfaction can suffer when repairs drag on, especially if drivers face extra expenses or poor communication. However, insurers have learned that managing expectations and keeping customers informed can maintain satisfaction even during long delays. Don’t be surprised if your insurance adjuster proactively updates you or offers digital tools to track the claim—it’s their way of easing frustration during the wait.

Bringing Tariffs Into the Mix

On top of pandemic-era hangovers, recent tariffs on imported auto parts and raw materials have further squeezed supply and driven prices upward. Since early 2023, tariffs on steel, aluminum, and certain electronic components have added 5–10% to the cost of replacement parts. That increase not only raises your out-of-pocket expenses when you pick up your deductible, it can also prolong wait times, as shops and insurers debate whether to absorb higher costs or seek alternative suppliers. In some cases, tariffs have prompted shops to switch from OEM to aftermarket parts—where quality standards vary—or to delay orders while evaluating more affordable options. Being aware of these additional cost pressures can help you understand why estimates might rise mid-repair and why parts delivery windows have grown even wider.

Setting Realistic Expectations for Your Claim

For everyday drivers, the best approach in 2025 is to expect delays and plan accordingly. Nationwide, repair delays have risen due to parts and technician shortages, and in extreme cases it may take up to six months to fully repair a vehicle. While most claims won’t take that long, it’s wise to prepare for weeks of downtime for your car. Understand that these supply chain issues are largely outside of any one company’s control. Even your insurance company cannot magically source back-ordered parts faster. What they can do is help set proper expectations. Insurers are encouraging customers to remain patient and are focusing on empathy—showing concern for your situation and keeping you informed throughout the claim. By knowing upfront that a repair might not be quick, you can make better decisions about transportation and avoid frustration. The good news is that by late 2024 some bottlenecks began to ease; improved parts availability and more repair technicians have slightly shortened average repair times. Still, until the industry catches up, drivers should plan for longer-than-usual repair timelines when filing a claim.

Tips for a Smoother Claim Experience

Even with delays, there are steps you can take to navigate your damage claim more effectively:

Check your rental coverage: Before you file the claim, review whether your policy covers a rental car and for how long. Given repair delays, you might need a rental for several weeks. If your coverage is limited (or if you’re a claimant using the other driver’s insurance), discuss options with the adjuster. Knowing your rental allowance can prevent nasty surprises if the repair runs long. Consider alternative transportation or negotiating an extension (for 3rd party claims) if delays push you past your coverage period.

Communicate and stay informed: Maintain open lines of communication with both the insurance adjuster and the body shop. Ask the repair shop for an estimated timeline and whether any parts are on backorder. Regular updates (many insurers offer mobile apps or online trackers) will keep you informed of progress. If a part is delayed, knowing early allows you to adjust plans. Insurers should be keeping customers informed, but don’t hesitate to reach out for status updates so you stay in the loop.

Be flexible with parts and shops: Talk to your adjuster about what parts will be used to fix your car. In a shortage, an OEM part might be backordered for months. You could ask if a reliable aftermarket or used part is available sooner. Insurers often allow this, and it can dramatically cut wait time. Similarly, if your preferred shop has a long backlog, you might shop around for a reputable repair facility that can schedule you sooner. Many insurers have preferred shop networks – using one of those shops might streamline estimates and repairs.

Plan for the downtime: If your car is drivable and safe, you might hold off turning it in to the shop until parts arrive. Some repair shops will complete an initial estimate, order parts, and only start repairs once everything is in hand – this lets you keep driving your vehicle vs using up what may be limited rental coverage. If it’s not drivable, begin look into alternatives like public transportation, ride sharing, and carpooling as soon as possible.

Know when a car might be totaled: Lengthy delays sometimes coincide with higher repair costs. If your vehicle is older or the damage is severe, the insurer might declare it a total loss rather than repair it, especially as used-car values drop. This can actually save you from an endless wait for parts. While a totaled car means you’ll be car shopping, it might be better than waiting many months for a tricky repair. Keep this in mind when discussing the claim – ask your adjuster if the damage is near the total loss threshold. In 2025, total loss rates have increased in part because of these economic considerations.

By following these tips and staying proactive, you can take some of the sting out of repair delays. Filing an auto claim in 2025 requires a bit more patience and planning, but with realistic expectations and good communication, you’ll get through the process as smoothly as possible. While you can’t control the global parts supply—or the effects of new tariffs—you can control how prepared you are. Stay informed, and you’ll be better equipped to handle the wait—and get your wheels back on the road.

Extennsion is an auto claims processing and consulting company, focused on helping individuals and businesses make sense of all things auto claims.